Medicare Insurance Explained

What exactly are you getting with Medicare? And what are you purchasing with the different plans? Here’s a brief overview of each part of Medicare.

Original Medicare: Part A

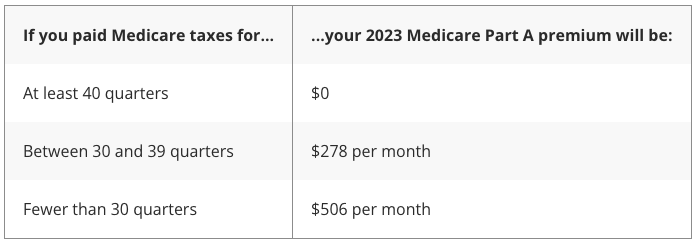

Part A is hospital insurance. It covers inpatient care in a hospital, skilled nursing facility, or nursing home. It also covers hospice care and home health care. Many people pay no premiums for Part A; this is determined by how long you worked and paid taxes to Medicare.

Part A also has a deductible you will pay each benefit period. As of 2022, this deductible is $1,556.

Original Medicare: Part B

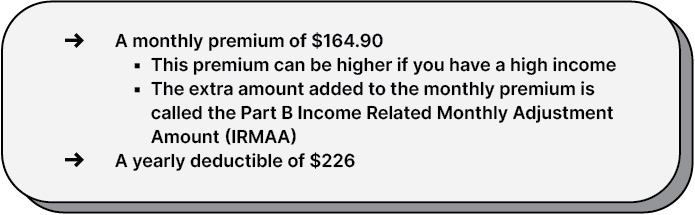

Part B is medical insurance. It covers outpatient care for doctor visits and emergency room visits, along with preventative care and medically necessary care. It also covers clinical research, ambulance services, durable medical equipment, mental health care, and limited outpatient prescription drugs.

Here are the costs you can expect to see with Part B in 2022:

Get all of your options

- Speak to a licensed agent

- Get A FREE Quote

Medicare Advantage (Part C)

Medicare Advantage plans cover the same services as Part A and Part B and may offer additional coverage or prescription drug coverage!

Many Medicare Advantage plans have little to no monthly premium, but you will still be responsible for the cost of this plan, plus your Part A and B costs. However, Medicare Advantage plans have an out-of-pocket maximum that helps to limit your spending.

Medicare Part D: Prescription Drug Plans

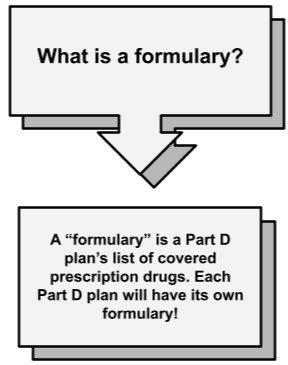

Medicare Part D plans cover prescription drugs. All plans cover at least two drugs in the most commonly prescribed categories. You can find out which drugs are covered by viewing a plan’s formulary.

You will pay monthly premiums for Part D. If you have a high income, you may have to pay Medicare an additional charge called the Part D Income Related Monthly Adjustment Amount (IRMAA).

You may also have a yearly plan deductible. Some plans will have no deductible, but if there is a deductible, it cannot exceed $505. Once you meet your plan deductible, you will pay copayments for each drug. These copayment amounts are determined by your plan’s tier list, which sorts drugs based on whether they are generic, brand-name, preferred, or specialty.

Medicare Supplements

Medicare Supplement insurance, or Medigap plans, covers the out-of-pocket expenses from Part A and Part B. The ten available plans cover some or all of the following:

- Part A coinsurance and hospital costs

- Part B copayments and coinsurance

- Your first 3 pints of blood

- Part A hospice care

- Skilled nursing facility care

- Part A deductible

- Part B deductible

- Part B excess charges

- Foreign travel emergency care (80%)

You can have either a Medicare Supplement plan or Medicare Advantage plan, but not both.